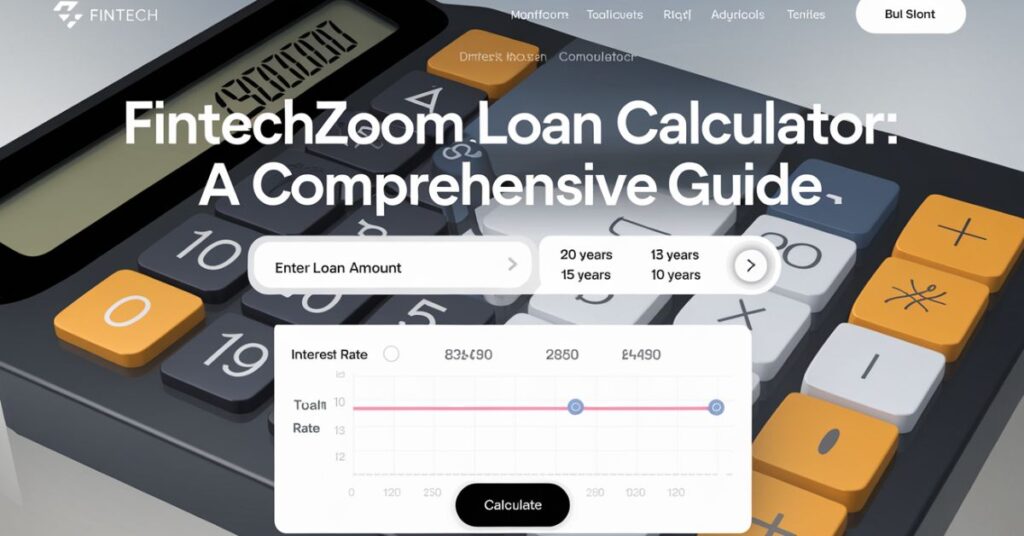

In the labyrinth of personal finance, finding the right loan can feel like searching for a needle in a haystack. Enter the FintechZoom Loan Calculator – your trusty compass in the world of borrowing. This nifty tool isn’t just another number cruncher; it’s your ticket to financial clarity and smarter decisions. Let’s dive into the nitty-gritty of this game-changing calculator and discover how it can transform your approach to loans. FintechZoom Loan Calculator: A Comprehensive Guide.

FintechZoom Loan Calculator: Your Financial Swiss Army Knife

Picture this: you’re standing at the crossroads of multiple loan offers, each promising to be the best. How do you cut through the noise? That’s where the FintechZoom Loan Calculator swoops in like a financial superhero. This isn’t your grandpa’s loan calculator – it’s a sleek, user-friendly powerhouse that turns complex financial jargon into plain English.

The interface is a breath of fresh air. No more squinting at tiny numbers or drowning in a sea of confusing fields. With FintechZoom’s calculator, you’re greeted by a clean, intuitive layout that practically holds your hand through the process. Here’s what you’ll find:

- Loan Amount: How much do you need? Whether it’s for a new ride or that dream home, punch it in.

- Interest Rate: The pesky percentage that can make or break your budget.

- Loan Term: How long are you in for? Months? Years? You decide.

- Extra Payments: For the overachievers looking to crush that debt faster.

Crunching the Numbers: How It Works

Behind the scenes, the FintechZoom Loan Calculator is a mathematical marvel. It’s not something akin to plucking figures off the hat – it uses complex equations that would impress even your high school maths teacher. The calculator uses the principle of amortization, which is a fancy way of saying it breaks down your loan payments over time. FintechZoom Loan Calculator: A Comprehensive Guide.

Here’s the secret sauce:

- It starts with the basic loan formula: PMT = P[r(1+r)^n]/[(1+r)^n-1], where:

- PMT = monthly payment

- P = principal loan amount

- r = monthly interest rate

- n = number of months

- Then, it factors in any extra payments or unique terms you’ve specified.

- Finally, it runs these calculations through multiple scenarios to give you a comprehensive view of your loan.

The result? Accuracy you can bank on. FintechZoom’s calculator isn’t playing fast and loose with your financial future – it’s giving you rock-solid numbers you can trust.

Results: Decoding Your Financial Future

After you’ve punched in your numbers and hit that calculate button, FintechZoom doesn’t just spit out a single figure. Oh no, it rolls out the red carpet of results. Here’s what you’ll get:

The Result Includes:

- Monthly Payment Breakdown: See exactly how much you’ll be shelling out each month.

- Total Interest Paid: Brace yourself – this number might surprise you.

- Amortization Schedule: A detailed roadmap of your loan journey, showing how each payment chips away at your principal and interest.

- Visual Representations: Because sometimes, a picture is worth a thousand words (or dollars, in this case).

But FintechZoom doesn’t stop there. It’s like the Swiss Army knife of loan calculators, packed with features you didn’t even know you needed:

- Loan Comparison Tool: See how different loan options stack up side by side.

- “What-If” Scenarios: Play financial time traveler and explore the impact of extra payments or changes in loan terms.

- Export and Share: Because sometimes you need a second opinion (or just want to show off your financial savvy).

How the FintechZoom Loan Calculator Works: Peeling Back the Curtain

Using the FintechZoom Loan Calculator is easier than ordering your morning coffee. Here’s the step-by-step:

- Enter the Loan Amount: How much are you borrowing? $10,000 for a car? $300,000 for a house? Type it in.

- Input the Interest Rate: This is where things get real. Even a 1% difference can mean thousands over the life of your loan.

- Set the Loan Term: How long do you want to be paying this off? Remember, shorter terms usually mean higher payments but less interest overall.

- Add Any Extra Details: Planning to make extra payments? Have a balloon payment at the end? Include it here.

- Hit Calculate: Watch as FintechZoom works its magic, instantly updating your results.

“The FintechZoom Loan Calculator turned what used to be a headache-inducing process into a breeze. I finally understand what I’m signing up for!” – Sarah T., First-time Homebuyer

The beauty of this calculator lies in its real-time updates. Tweak any input, and watch as the results instantly adjust. It’s like having a financial advisor at your fingertips, 24/7. FintechZoom Loan Calculator: A Comprehensive Guide.

Factors to Consider Before Taking Out a Loan: More Than Just Numbers

While the FintechZoom Loan Calculator is a powerful tool, remember that borrowing money is a big decision. Here are some important things to remember:

- Interest Rates: The calculator shows you the impact, but do you understand the difference between fixed and variable rates? A fixed rate might start higher but offers stability, while a variable rate could save you money – or cost you big time if rates rise.

- Loan Terms: Shorter terms mean higher payments but less interest overall. Longer terms reduce monthly expenses but increase overall costs. Use the calculator to find your sweet spot.

- Hidden Costs: Watch out for:

- Origination fees

- Prepayment penalties

- Late payment fees

- Annual fees

The FintechZoom calculator helps you factor these in, ensuring you’re not blindsided down the road.

Tips for Choosing the Right Loan Option: Navigating the Lending Labyrinth

Armed with the FintechZoom Loan Calculator, you’re already ahead of the game. But here are some extra tips to ensure you’re making the best choice:

- Know Your Credit Score: This three-digit number can make or break your loan terms. Before you start plugging numbers into the calculator, check your credit score. The better your score, the better your terms – and the more accurate your calculations will be.

- Shop Around: Never accept the first offer you receive. Use the FintechZoom calculator to compare loans from:

- Traditional banks

- Credit unions

- Online lenders

- Peer-to-peer lending platforms

- Read the Fine Print: The calculator gives you the numbers, but it’s up to you to understand the terms. Watch out for:

- Prepayment penalties

- Adjustable rates

- Balloon payments

Remember, the FintechZoom Loan Calculator is a tool, not a crystal ball. Use it in conjunction with careful research and, if needed, professional advice.

Advantages of Using the FintechZoom Loan Calculator: Your Financial Crystal Ball

Why should you make the FintechZoom Loan Calculator your go-to financial tool? Let’s break it down:

- Time-Saving Benefits:

- Compare multiple scenarios in minutes, not hours.

- Get instant answers to “what-if” questions without complex math.

- Informed Decision-Making:

- Understand the true cost of borrowing beyond just the monthly payment.

- See how different terms affect your long-term financial health.

- Budgeting Made Easy:

- Visualize how loan payments fit into your overall financial picture.

- Avoid overextending yourself by seeing the full impact of a loan.

Real-Life Applications of the Loan Calculator: From Theory to Practice

Let’s put the FintechZoom Loan Calculator through its paces with some real-world scenarios:

Case Study: Home Sweet Home

Meet Tom and Lisa, first-time homebuyers eyeing a $300,000 house. They’re torn between a 30-year fixed mortgage at 3.5% and a 15-year at 3%. Using the FintechZoom calculator, they discover:

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 30-year | $1,347 | $184,968 |

| 15-year | $2,072 | $73,040 |

The calculator shows them that while the 15-year loan has higher monthly payments, it saves them a whopping $111,928 in interest over the life of the loan. Armed with this information, they decide to stretch their budget for the 15-year option, knowing it’ll pay off big time in the long run. FintechZoom Loan Calculator: A Comprehensive Guide.

Scenario: New Wheels vs. Used Deals

John’s in the market for a car and is debating between a new model at $25,000 with 0% financing for 60 months, or a used version at $15,000 with a 4.5% interest rate for 48 months. The FintechZoom calculator reveals:

| Option | Monthly Payment | Total Cost |

|---|---|---|

| New | $417 | $25,000 |

| Used | $344 | $16,512 |

While the new car offers tempting 0% financing, John realizes he’ll save $8,488 by opting for the used car, even with interest. The calculator helps him see past the allure of “zero interest” to the bigger financial picture.

Conclusion: Empowering Your Financial Journey

The FintechZoom Loan Calculator isn’t just a tool – it’s your financial sidekick, ready to help you navigate the complex world of loans with confidence. By providing clear, comprehensive insights into your borrowing options, it empowers you to make decisions that align with your financial goals and realities.

FAQs: Demystifying Loan Calculations

- How accurate is the FintechZoom Loan Calculator?

The calculator uses industry-standard formulas and up-to-date financial principles, ensuring high accuracy. However, remember that it’s a tool for estimation – always consult with a financial professional for major decisions. - Can I use the calculator for business loans?

Absolutely! While it’s great for personal loans, the FintechZoom calculator is versatile enough for basic business loan calculations too. - Does the calculator take my credit score into account?

The calculator doesn’t directly factor in your credit score. However, you can use it to compare different interest rates that might be offered based on your credit score. - How often should I use the loan calculator when shopping for loans?

Use it as often as you need! It’s a great tool for comparing different offers or seeing how changes in your financial situation might affect your borrowing power. - Can the FintechZoom Loan Calculator help me decide between paying off debt or investing?

While primarily designed for loan calculations, you can use it to compare the interest you’d pay on debt versus potential investment returns. However, for complex financial decisions, consider consulting a financial advisor. - Are there mobile apps available for the FintechZoom Loan Calculator?

Check the FintechZoom website or your app store for the most up-to-date information on mobile availability. - How does the FintechZoom calculator compare to other online loan calculators?

The FintechZoom calculator stands out for its user-friendly interface, comprehensive results, and additional features like loan comparisons and “what-if” scenarios. - Can I save my calculations for future reference?

Many online calculators, including FintechZoom, offer options to save or export your results. Check the calculator’s features for specific saving and sharing capabilities.