In the labyrinth of home financing, finding your way can be a daunting task. Enter the FintechZoom Mortgage Calculator – a beacon of clarity in the complex world of mortgages. Whether you’re a first-time homebuyer or a seasoned property investor, this powerful tool is designed to simplify your journey toward homeownership. Let’s dive into how this innovative calculator can transform your approach to mortgage planning and help you make informed decisions about one of life’s most significant investments. FintechZoom Mortgage Calculator – Simplify Your Home Financing.

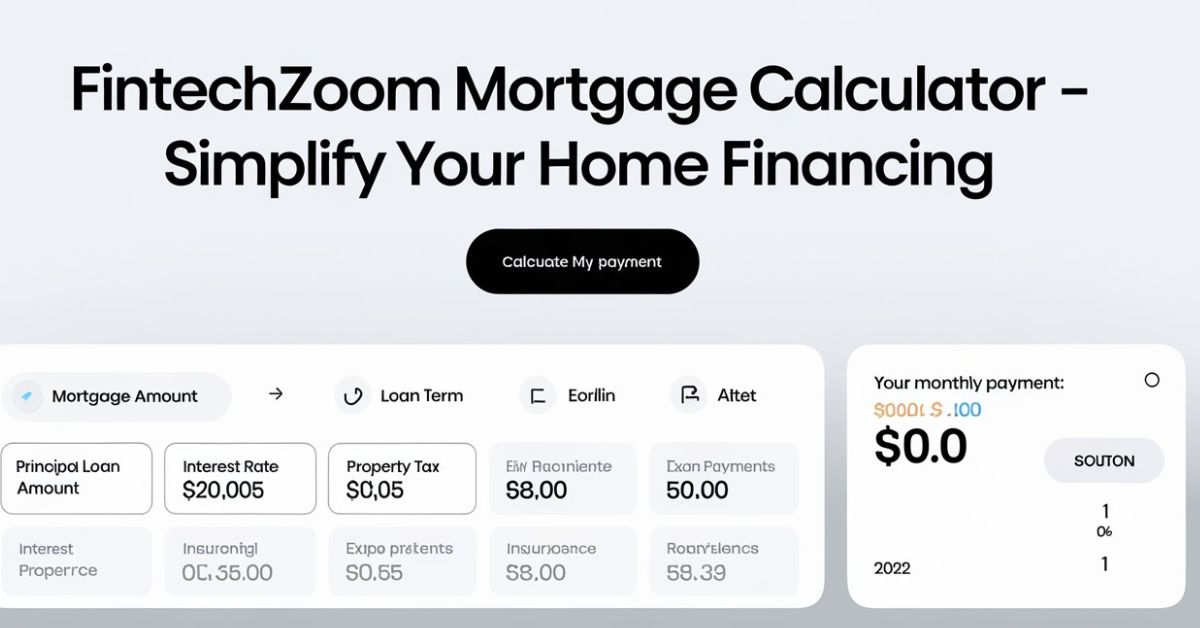

Get Online FintechZoom Mortgage Calculator

Embark on your home financing journey with ease by accessing the FintechZoom Mortgage Calculator here. This user-friendly tool is just a click away, offering you instant access to sophisticated mortgage calculations without the need for complex financial knowledge.

The FintechZoom Mortgage Calculator stands out with its intuitive interface and comprehensive features. It’s not just a number cruncher; it’s your financial advisor, available 24/7. With its ability to handle various scenarios and its up-to-date market data, this calculator is your first step toward making your dream home a reality. FintechZoom Mortgage Calculator – Simplify Your Home Financing.

What is a Mortgage Calculator?

A mortgage calculator is a digital tool that helps prospective homeowners estimate their monthly mortgage payments based on various inputs such as loan amount, interest rate, and loan term. But the FintechZoom Mortgage Calculator takes this concept further, offering a more comprehensive analysis of your potential home loan. FintechZoom Mortgage Calculator – Simplify Your Home Financing.

There are several types of mortgage calculators available:

- Basic calculators: Provide simple monthly payment estimates

- Advanced calculators: Include additional costs like property taxes and insurance

- Comparison calculators: Allow users to compare different loan scenarios side-by-side

- Amortization calculators: Show the loan balance and interest paid over time

The FintechZoom Mortgage Calculator combines the best features of these types, offering a holistic approach to mortgage planning. It not only calculates your monthly payments but also provides insights into the long-term financial implications of your mortgage choice. FintechZoom Mortgage Calculator – Simplify Your Home Financing.

Benefits of Using a Mortgage Calculator

Utilizing the FintechZoom Mortgage Calculator brings a plethora of advantages to your home financing journey:

- Financial Planning and Budgeting: Get a clear picture of your future financial commitments, allowing you to plan your budget effectively.

- Scenario Comparison: Easily compare different loan terms, interest rates, and down payment amounts to find the best fit for your financial situation.

- Time-saving: Instantly access complex calculations that would take hours to compute manually.

- Informed Decision-Making: Arm yourself with accurate information to negotiate better terms with lenders and make confident choices.

- Long-Term Financial Visibility: Understand the total cost of your loan over its entire lifetime, not just the monthly payments.

“Knowledge is power. The FintechZoom Mortgage Calculator empowers homebuyers with the knowledge they need to make one of life’s biggest financial decisions.” – Financial expert Jane Doe

How to Use the FintechZoom Mortgage Calculator

Navigating the FintechZoom Mortgage Calculator is a breeze. Follow these steps to get a comprehensive view of your potential mortgage:

- Enter the Loan Amount: Input the total amount you plan to borrow.

- Select the Loan Term: Choose the duration of your loan, typically 15 or 30 years.

- Input the Interest Rate: Enter the annual interest rate offered by your lender.

- Add Property Taxes and Insurance: Include annual property taxes and homeowners insurance for a more accurate estimate.

Advanced features unique to the FintechZoom calculator include:

- PMI calculator for loans with less than 20% down payment

- Adjustable-rate mortgage (ARM) options

- Refinancing comparison tools

- Integration with real-time market data for accurate interest rate estimates

Understanding the Results

The FintechZoom Mortgage Calculator doesn’t just spit out numbers; it provides a comprehensive breakdown of your potential mortgage:

| Component | Description |

|---|---|

| Principal & Interest | The core of your monthly payment |

| Property Taxes | A sum of all above components |

| Homeowners Insurance | Estimated monthly insurance costs |

| PMI (if applicable) | Additional cost for down payments below 20% |

| Total Monthly Payment | A sum of all the above components |

Beyond the monthly payment, the calculator offers:

- Amortization Schedule: A detailed year-by-year breakdown of how your payments are applied to principal and interest.

- Total Interest Paid: The sum of all interest payments over the life of the loan.

- Interactive Graphs: Visual representations of your loan’s payoff progress and the impact of extra payments.

Understanding these results empowers you to make informed decisions about your mortgage and long-term financial health. FintechZoom Mortgage Calculator – Simplify Your Home Financing.

Factors to Consider When Using a Mortgage Calculator

While the FintechZoom Mortgage Calculator provides valuable insights, it’s crucial to consider various factors that can affect your actual mortgage costs:

- Interest Rate Fluctuations: Rates can change daily, impacting your potential payments.

- Down Payment Variations: A larger down payment can significantly reduce your monthly costs and eliminate PMI.

- Private Mortgage Insurance (PMI): Required for conventional loans with less than 20% down payment.

- Property Taxes and Homeowners Insurance: These can vary greatly depending on location and property value.

- HOA Fees: If applicable, these can add a substantial amount to your monthly housing costs.

- Closing Costs: Upfront fees that are typically 2-5% of the loan amount.

Remember, the calculator provides estimates based on the information you input. For the most accurate picture, gather as much specific information about your potential loan and property as possible. FintechZoom Mortgage Calculator – Simplify Your Home Financing.

Tips for Effective Mortgage Planning

To make the most of the FintechZoom Mortgage Calculator and your overall mortgage planning process, consider these tips:

- Assess Your Financial Health

- Review your credit score and report

- Calculate your debt-to-income ratio

- Evaluate your savings for down payment and reserves

- Determine Your Home-Buying Budget

- Use the 28/36 rule as a starting point (no more than 28% of income on housing, 36% on total debt)

- Factor in future financial goals and potential income changes

- Explore Different Loan Types

- Conventional loans

- FHA loans

- VA loans (for eligible veterans)

- USDA loans (for rural properties)

- Consider the Impact of Credit Scores

- Higher scores typically mean lower interest rates

- Use the calculator to see how different rates affect your payments

- Plan for Future Financial Changes

- Job changes or income fluctuations

- Family planning and associated costs

- Potential home renovations or upgrades

By integrating these considerations with the insights provided by the FintechZoom Mortgage Calculator, you’ll be well-equipped to make a sound financial decision.

How FintechZoom Mortgage Calculator Sets Itself Apart

The FintechZoom Mortgage Calculator isn’t just another online calculator; it’s a comprehensive financial tool designed to give you a competitive edge in your home-buying journey.

Unique Features:

- Real-time interest rate updates based on market conditions

- Integration with credit score data for personalized rate estimates

- Ability to factor in potential home value appreciation

- Refinancing breakeven calculator

User Experience:

The calculator boasts an intuitive interface that guides users through the process, explaining financial terms and concepts along the way. Its responsive design ensures a seamless experience across devices, from desktop to mobile.

Data Integration:

FintechZoom’s calculator pulls data from multiple sources, including:

- Current market interest rates

- Local property tax information

- Regional home insurance cost averages

This integration provides a more accurate and localized estimate of your potential mortgage costs.

Is the FintechZoom Mortgage Calculator free to use?

Yes, the FintechZoom Mortgage Calculator is completely free to use. This commitment to accessibility sets it apart from some competitors who charge for advanced features or limit the number of calculations you can perform.

Value Proposition:

- Unlimited calculations at no cost

- Access to premium features without a paywall

- Regular updates to ensure accuracy and relevance

By offering this powerful tool for free, FintechZoom demonstrates its commitment to empowering consumers in their financial decision-making process.

Can I use the calculator to compare different mortgage options?

Absolutely! The FintechZoom Mortgage Calculator excels at comparing various mortgage scenarios. Here’s how you can leverage this feature:

- Fixed-Rate vs. Adjustable-Rate Mortgages (ARMs)

- Input different interest rates and terms

- Compare the long-term costs and risks of each option

- Loan Term Comparison

- See how 15-year vs. 30-year terms affect your monthly payments and total interest paid

- Points and Fees Analysis

- Factor in different closing costs and points to see their impact on your loan

By running multiple scenarios, you can gain a clear picture of which mortgage option aligns best with your financial goals and constraints.

Is the FintechZoom Mortgage Calculator available on mobile devices?

In today’s on-the-go world, accessibility is key. The FintechZoom Mortgage Calculator is designed with mobile users in mind:

- Responsive Web Design: Access the full functionality of the calculator from any web browser on your smartphone or tablet.

- Mobile App: A dedicated app is available for both iOS and Android devices, offering enhanced features and offline capabilities.

- Cross-Device Synchronization: Save your calculations and access them across all your devices, ensuring seamless continuity in your mortgage planning process.

Whether you’re at home on your desktop or touring open houses with your smartphone, the FintechZoom Mortgage Calculator is always at your fingertips.

How accurate are the results provided by the calculator?

The FintechZoom Mortgage Calculator prides itself on providing highly accurate estimates. However, it’s important to understand the factors that contribute to its accuracy:

Data Sources:

- Real-time interest rate feeds from major lenders

- Regular updates to tax and insurance data

- Integration with economic forecasting models

Update Frequency:

- Interest rates are updated daily

- Property tax and insurance data refreshed monthly

- Economic models are recalibrated quarterly

While the calculator strives for accuracy, it’s important to note that the final terms of your mortgage will depend on factors such as your credit score, the specific lender’s policies, and market conditions at the time of your application.

“In our annual review of mortgage calculators, FintechZoom consistently ranks in the top tier for accuracy and comprehensive data integration.” – Mortgage Industry Analyst John Smith

Can the calculator be used for refinancing purposes?

The FintechZoom Mortgage Calculator is indeed a valuable tool for those considering refinancing their existing mortgage. Here’s how you can use it for refinancing scenarios:

- Current vs. New Mortgage Comparison

- Input your current mortgage details

- Enter potential new loan terms

- Compare monthly payments, total interest, and loan terms side by side

- Break-Even Analysis

- Calculate how long it will take for the savings from lower payments to offset the costs of refinancing

- Determine if refinancing aligns with your long-term financial goals

- Cash-Out Refinance Evaluation

- Assess the impact of borrowing additional funds against your home equity

- Compare different cash-out amounts and their effect on your monthly payments and total loan cost

By utilizing these features, you can decide whether refinancing is the right move for your financial situation.

Conclusion

The FintechZoom Mortgage Calculator is an indispensable tool in the complex landscape of home financing. Its user-friendly design, comprehensive features, and accurate data make it a standout choice for anyone navigating the mortgage process.

From first-time homebuyers to seasoned investors considering refinancing, this calculator offers valuable insights that can lead to significant financial savings and more informed decision-making. Providing a clear picture of your potential mortgage scenarios, it empowers you to approach lenders with confidence and negotiate terms that align with your financial goals.

FAQs

- How often should I use the mortgage calculator during my home-buying process?

Use the calculator regularly as you progress through your home-buying journey. Revisit your calculations when you find properties of interest, receive new interest rate quotes, or if your financial situation changes. - Can the FintechZoom Mortgage Calculator help me determine how much house I can afford?

Yes, by inputting your income, debts, and other financial details, you can use the calculator to estimate a comfortable home price range based on standard lending criteria. - Does the calculator account for closing costs?

While the basic calculation focuses on monthly payments, you can factor in closing costs by adjusting the loan amount or using the advanced features to see how these upfront costs affect your overall financial picture. - How does the FintechZoom Mortgage Calculator handle adjustable-rate mortgages?

The calculator allows you to input initial rates and adjustment periods for ARMs, providing estimates for how your payments might change over time based on potential rate increases. - Can I save my calculations for future reference?

Yes, the FintechZoom Mortgage Calculator allows you to create an account where you can save multiple scenarios, making it easy to compare and revisit your calculations throughout your home-buying process.